Diving into the world of crypto trading can feel thrilling, but without a solid routine, it’s easy to get lost in the chaos. I’ve learned that success in this fast-paced market isn’t just about picking the right coins—it’s about having a disciplined approach that keeps emotions in check and decisions strategic.

Understanding Crypto Trading

Crypto trading involves buying and selling digital assets to generate profit. Navigating these markets requires both strategic insight and adaptability to changing conditions.

Basics Of Cryptocurrency Markets

- Cryptocurrency markets operate 24/7, allowing trading at any time. Unlike traditional exchanges, these markets rely on decentralized blockchain technology, providing transparency and security.

- Digital assets, such as Bitcoin and Ethereum, dominate market capitalization. Altcoins like Solana and Cardano also offer diversification opportunities. Prices fluctuate based on demand, regulations, and technological advancements.

- Market participants include institutional investors, retail traders, and miners. Exchanges, such as Binance and Coinbase, facilitate trading, while wallets secure digital holdings. Familiarity with these components enhances decision-making.

Risks And Rewards Of Crypto Trading

- Crypto trading offers potential for high returns but comes with significant risk. Volatility, where prices can swing by 10% or more in a single day, creates opportunities and challenges.

- Security risks, like hacking and phishing scams, threaten funds on unsecured platforms. Regulatory uncertainty in some regions can also impact asset values. Diversification reduces exposure to any single asset’s downturn.

- Rewards include leveraging price movements for profit. Day traders exploit short-term trends, while long-term investors benefit from substantial price appreciation. Effective risk management ensures sustainable growth.

Importance Of A Trading Routine

A structured trading routine plays a key role in achieving consistency and reducing risks in the crypto market. It establishes discipline, minimizes impulsive actions, and maximizes the potential for profitable trades.

Benefits Of Consistency

Consistency ensures that trading decisions are aligned with a well-defined strategy. By sticking to a routine, I can better analyze market trends, identify patterns, and react promptly to favorable opportunities. Consistent behavior helps me maintain a clear investment approach, reducing errors caused by randomness. For example, applying stop-loss orders in every trade lowers potential losses during sudden market dips.

Avoiding Emotional Trading

A trading routine helps me avoid making decisions driven by fear or excitement. Emotional trading, such as panic selling during market crashes, often leads to financial losses. Routine-based strategies, like planning trades in advance and setting predefined entry and exit points, protect me from reacting impulsively to short-term price movements. For instance, I rely on technical indicators like the RSI or moving averages to validate decisions, rather than emotions.

Key Elements Of A Profitable Crypto Trading Routine

A profitable crypto trading routine includes clear goals, effective risk management, and a structured schedule. Each element ensures consistency and minimizes errors in dynamic and unpredictable markets.

Setting Clear Goals

I establish specific, measurable trading goals to maintain focus. These can include:

- daily profit targets

- percentage-based returns

- portfolio growth benchmarks

With clear goals, I track progress and make data-driven adjustments to my strategies. For example, I might aim for a 3% monthly portfolio growth or set a loss limit of no more than 1% per trade.

Developing A Risk Management Plan

I design a risk management plan to protect my capital from market volatility. Setting a maximum acceptable loss per trade, such as 1-2% of total capital, helps limit downsides. Stop-loss orders and position sizing ensure trades align with my risk tolerance. Diversifying across assets, like Bitcoin, Ethereum, and altcoins, reduces exposure to single-market events.

Creating A Trading Schedule

I follow a structured trading schedule to avoid overtrading and exhaustion. I allocate specific hours for market analysis, trade execution, and performance reviews. For instance, I might assess the market before major exchange volume peaks, such as during the London and New York trading overlaps. A consistent schedule keeps my routine disciplined and my decisions timely.

Tools And Resources For Crypto Trading

Using the right tools and resources enhances efficiency and decision-making in crypto trading. These tools streamline processes, provide critical insights, and help maintain a structured routine.

Essential Trading Platforms And Apps

Crypto exchanges and trading apps serve as the foundation for executing trades. I rely on exchanges like Binance, Coinbase, and Kraken for their security, liquidity, and user-friendly interfaces. Mobile apps from these platforms enable on-the-go trading and real-time portfolio management. Additionally, wallet apps such as MetaMask and Trust Wallet store digital assets securely while facilitating transactions.

For monitoring prices and setting alerts, apps like CoinGecko and CoinMarketCap provide accurate data on cryptocurrencies, including market caps, trading volumes, and historical trends. Using secure and reliable wallets and trading platforms minimizes the risk of hacks and account breaches.

Leveraging Trading Bots And Algorithms

Trading bots perform automated trades based on predefined strategies. I use bots on platforms like 3Commas and CryptoHopper to automate repetitive tasks, reduce manual errors, and execute trades 24/7. These bots optimize strategies like grid or arbitrage trading, ensuring no opportunity slips through during market fluctuations.

Algorithmic trading tools refine decision-making by leveraging AI and historical data for predictive analysis. Platforms such as Quadency and Tuned offer algorithm templates or customizable strategies suitable for traders at different experience levels. Using bots requires precise configurations and regular adjustments to reflect changing market conditions.

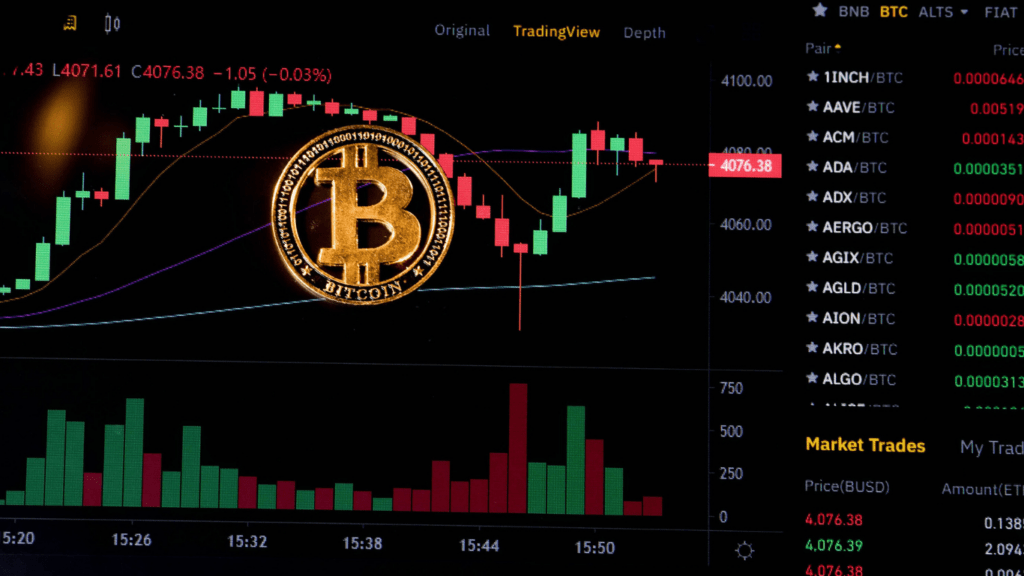

Analyzing Market Trends And Data

Market analysis tools provide critical insights into price movements and trading volumes. Tools like TradingView and Coinigy offer advanced charting features and technical indicators like MACD, RSI, and moving averages. These features help identify potential entry and exit points.

For fundamental analysis, I monitor news aggregators like CryptoPanic or sources like Glassnode for on-chain metrics, such as supply distributions and network activity. Reviewing sentiment analysis from tools like LunarCrush helps gauge market psychology. Comprehensive data analysis enables me to predict trends accurately and adjust strategies accordingly.

Tips To Optimize Your Trading Routine

Optimizing a trading routine enhances consistency and improves profitability in the cryptocurrency market. Adopting actionable strategies helps manage risks and maximizes opportunities effectively.

Regularly Review And Adjust Your Strategy

I analyze my trading performance weekly to identify areas for improvement. Reviewing historical data helps me understand patterns and refine strategies, ensuring my approach remains adaptable to market shifts. For example, I assess the effectiveness of my risk management techniques, such as stop-loss thresholds. By adjusting methods based on data, I maintain relevance in changing market conditions.

Focusing On Learning And Growth

Continuous learning keeps my trading skills sharp in a rapidly evolving crypto landscape. I dedicate time daily to studying market trends, new tools, and blockchain innovations. Diversifying resources, like trading courses and webinars, broadens my knowledge. For instance, using news aggregators helps me stay informed about regulatory changes, while technical analysis books improve my charting skills.

Building Discipline And Patience

Maintaining discipline minimizes impulsive trading and prevents emotional reactions to volatility. I stick to a trading schedule and predefined plans, avoiding overexposure in high-risk trades. For instance, I set clear entry and exit points, ensuring I remain consistent with my strategy. Patience allows me to wait for optimal conditions, reducing the likelihood of costly mistakes.

Blockchain Tech Contributor

Blockchain Tech Contributor