The financial world is evolving fast, and the lines between traditional and digital markets are blurring. As someone who’s watched both stocks and cryptocurrencies closely, I’ve noticed an intriguing connection between these two seemingly different asset classes. Their movements often mirror each other, sparking debates about how intertwined they really are.

Understanding The Correlation Between Stocks And Crypto Markets

The relationship between stocks and cryptocurrency markets has become a focal point for analysts. Both asset classes exhibit interconnected patterns, revealing how broader market factors influence them.

What Is Correlation In Financial Markets?

Correlation in financial markets measures the degree to which two asset classes move in relation to one another. A positive correlation indicates synchronized movements, while a negative one signals opposite trends. For example, a correlation coefficient of +1 suggests identical behavior, whereas -1 reflects entirely inverse patterns. Correlation values between -1 and +1 show partial alignment or divergence.

Identifying these relationships helps investors anticipate market shifts. If cryptocurrencies, such as Bitcoin or Ethereum, consistently mirror stock movements, it’s likely due to underlying factors like:

- macroeconomic data

- risk sentiment

- liquidity flows

Brief Overview Of Stocks And Cryptocurrency

Stocks represent ownership in companies and are driven by fundamentals, including earnings reports and sector performance. Major indices like the S&P 500 and Nasdaq track cumulative stock activity, reflecting the global economy’s health. Stocks operate within long-established regulatory environments.

Cryptocurrencies are digital assets based on blockchain technology. Unlike traditional equities, their value derives from decentralized networks, adoption rates, and market sentiment. Significant coins like Bitcoin and altcoins such as Solana and Cardano are often influenced by factors like innovation and regulatory developments.

The growing overlap stems from investor behavior. Many now treat cryptocurrencies as alternative assets, broadening portfolios that traditionally focused on equities.

Factors Driving Correlation Between Stocks And Crypto

Stocks and cryptocurrencies often display synchronized trends, affected by shared economic, social, and global factors. Identifying these drivers helps clarify the interplay between these markets.

Economic Indicators And Market Trends

- Economic indicators, such as inflation rates, GDP growth, and employment data, influence both stocks and crypto.

- Rising inflation, for instance, increases demand for assets perceived as hedges, like Bitcoin or gold-related stocks.

- Central bank policies, like interest rate adjustments, also affect these markets similarly.

- Tighter monetary policy reduces liquidity, negatively impacting growth-oriented stocks and speculative crypto investments.

- Market trends, including shifts in liquidity or institutional fund movements, contribute to correlations.

- During liquidity surges, risk assets like tech stocks and major cryptocurrencies (e.g., Ethereum) tend to rise in tandem.

- Conversely, downturns in economic cycles often drive simultaneous declines across these sectors.

Investor Behavior And Sentiment

Investor sentiment bridges the behavior across stocks and crypto. Risk-on sentiment leads investors to allocate capital toward high-growth stocks and volatile cryptocurrencies. For example, during tech bull markets, cryptocurrencies typically see stronger price momentum. In contrast, risk-off sentiment, triggered by fears of economic slowdown, drives simultaneous sell-offs.

Additionally, retail participation heavily influences both markets. Investors often shift allocations between trending sectors, like tech equities and digital assets, amplifying interdependencies. Surges in social media-driven sentiment can spark significant, parallel spikes.

Impact Of Global Events

Global events, including geopolitical tensions, pandemics, or energy crises, impact both assets. For instance, the Russia-Ukraine conflict in early 2022 increased market uncertainty, leading to synchronized declines in equities and crypto. Similarly, the COVID-19 pandemic triggered correlated market volatility.

Decoupling effects might occur based on event-specific factors. For example, a nation’s crypto regulation may disproportionately affect digital markets while equity indices remain less impacted, highlighting contextual dependencies in correlation strength.

Historical Trends In Market Correlation

Historical data shows fluctuations in the correlation between stocks and cryptocurrencies, shaped by market conditions and external events. Analyzing these trends reveals distinct periods of alignment and divergence.

Implications For Investors

Understanding the connection between stocks and crypto markets equips investors to better navigate complexities in today’s financial environment. Strategic planning can mitigate risks and enhance portfolio performance.

Portfolio Diversification Strategies

Incorporating both stocks and cryptocurrencies into portfolios offers diversification benefits if managed strategically. Stocks, driven by company fundamentals (e.g., earnings, dividends), provide more stability. Cryptocurrencies, with higher volatility and potential for outsized gains, contribute risk-reward asymmetry.

Combining assets with differing risk profiles creates balanced exposure. For instance, pairing large-cap stocks with Bitcoin or Ethereum may hedge against sector-specific downturns in traditional markets. Adjusting allocations based on market conditions ensures alignment with investment objectives.

Risk Management Considerations

Adopting robust risk management practices ensures preparedness for cross-market volatility. Correlations between stocks and cryptocurrencies often increase during periods of economic uncertainty, amplifying downside risks. Maintaining resilience requires setting clear stop-loss limits and diversifying holdings across uncorrelated asset classes like bonds or commodities.

Monitoring macroeconomic indicators such as interest rate changes or inflation reports helps anticipate synchronized sell-offs. For example, tightening Federal Reserve policies could reduce liquidity, affecting both equity and crypto markets simultaneously. Using hedging strategies, like incorporating gold or stablecoins, can provide additional protection.

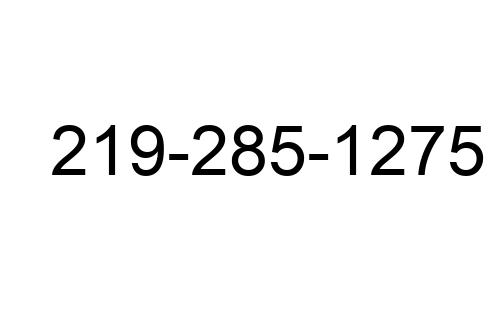

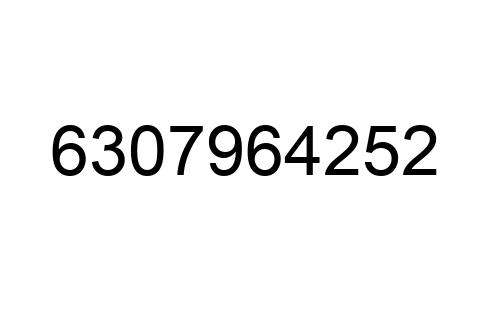

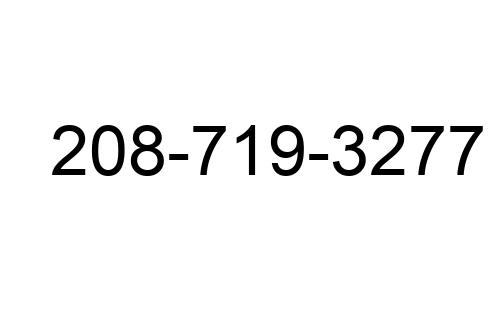

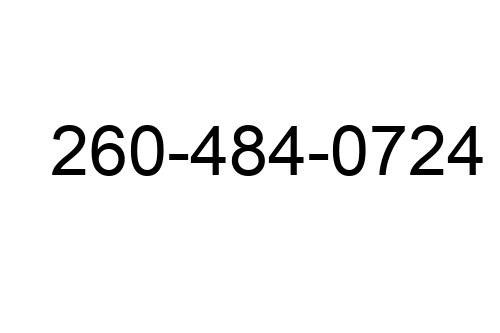

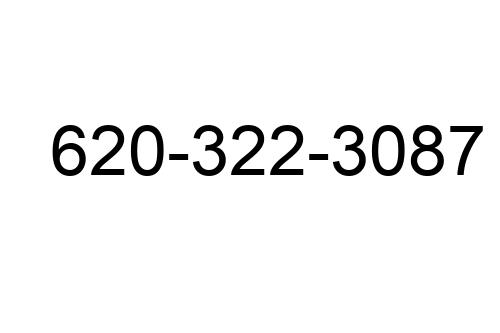

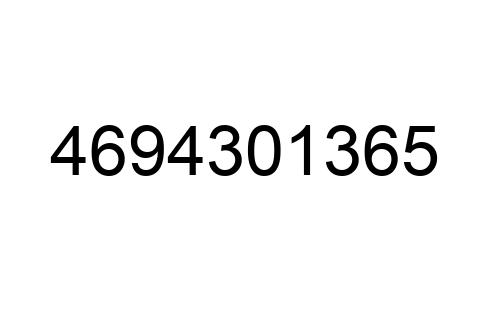

Market Analyst & Trading Strategist

Market Analyst & Trading Strategist