Investing in tokens can be an exciting way to grow your portfolio, but it’s not without its pitfalls. With the rapid rise of blockchain technology and cryptocurrencies, many investors dive in without fully understanding the risks. I’ve seen how easy it is to make mistakes that can cost time, money, and confidence.

Understanding Token Investments

Token investments revolve around blockchain-based digital assets representing various utilities or ownership. These assets include cryptocurrencies like Bitcoin, utility tokens such as those used within specific platforms or ecosystems, and security tokens tied to real-world assets.

Knowing the differences between these token types is crucial. Cryptocurrencies primarily act as a medium of exchange or a store of value (e.g., Bitcoin or Litecoin). Utility tokens grant access to products or services within a specific blockchain project, such as Ethereum-based applications. Security tokens represent ownership in physical assets like real estate or equities, and their issuance complies with regulatory frameworks.

Token prices often experience volatility due to market speculation, project developments, or external factors like regulatory announcements. Understanding the market dynamics and evaluating token use cases, development teams, and potential adoption helps avoid relying solely on price swings for investment decisions.

Mistake 1: Lack Of Research

Failing to conduct thorough research often leads to uninformed and risky decisions. Token investments require a deep understanding of the assets and the projects behind them.

Relying On Hype

Blindly following trends without analyzing the token’s value proposition is a frequent mistake. Viral social media posts or influencer endorsements can create temporary excitement, but they rarely indicate long-term viability. For example, meme coins like Dogecoin or Shiba Inu experience sharp fluctuations fueled by speculative demand rather than robust fundamentals. Relying on hype increases exposure to pump-and-dump schemes, leaving investments vulnerable to massive losses.

Ignoring Project Fundamentals

Overlooking critical project details undermines a token’s potential for growth or sustainability. Key factors, such as the utility of the token, the team’s experience, and the project’s roadmap, are essential to evaluate. For instance, tokens with undefined use cases or unrealistic development goals often fail to deliver value. Neglecting to review such:

- whitepaper

- partnerships

- tokenomics

puts investors at risk of backing poorly planned projects.

Mistake 2: Overlooking Risk Management

Ignoring risk management in token investments often leads to significant financial losses. A well-defined risk strategy helps protect your capital and ensures long-term success.

Investing More Than You Can Afford To Lose

Spending money you can’t afford to lose compromises financial stability. I focus on allocating a portion of my disposable income for token investments instead of relying on essential funds like rent or emergency savings. Tokens are highly volatile, with prices fluctuating drastically, so losing your investment in a downturn is possible. By setting strict investment limits, I reduce undue stress and maintain control over my finances.

Failing To Diversify Your Portfolio

Concentrating on a single token or project increases susceptibility to its specific risks. I avoid this mistake by diversifying across different tokens, categories, and use cases. For instance, I balance investments in cryptocurrencies, utility tokens, and security tokens. Diversification spreads risk across multiple assets, ensuring that underperformance in one token doesn’t devastate my portfolio. This approach also exposes me to various growth opportunities within the evolving blockchain ecosystem.

Mistake 3: Emotional Decision-Making

Emotional reactions often lead to poor investment decisions. In token investments, letting emotions drive actions can result in financial losses and missed opportunities.

Panic Selling During Market Drops

- Panic selling reduces potential gains and locks in losses.

- Market drops in the token space are common due to high volatility, but an impulsive sell-off during these periods often results in selling at a price lower than the token’s recovery value.

- In June 2021, Bitcoin’s price fell to $29,000 before recovering to $69,000 by November.

- Selling during that dip would have excluded investors from the later rally.

- I focus on evaluating project fundamentals and market conditions before reacting to price fluctuations, ensuring decisions align with long-term goals rather than short-term fear.

FOMO-Driven Purchases

Making decisions based on fear of missing out (FOMO) leads to overpaying for tokens or investing in speculative projects. When tokens experience rapid price spikes, FOMO can lead investors to buy during unsustainable rallies, as seen during initial coin offerings (ICOs) in 2017. Many projects lacked substance and quickly lost value after peaking. I always research tokens thoroughly to verify their utility, team credibility, and adoption potential rather than chasing hype from price charts or social media trends. This approach reduces exposure to inflated, unsustainable projects and preserves capital for more promising opportunities.

Mistake 4: Not Having A Clear Exit Strategy

A well-defined exit strategy is essential for managing token investments effectively. Without one, I risk losing potential profits or holding onto tokens indefinitely as their value declines.

Ignoring Long-Term Goals

Establishing long-term goals provides structure to investment decisions. When I neglect these goals, I may sell tokens prematurely or hold onto them beyond their peak value. For example, if my goal is to achieve a 50% return, failing to set this benchmark could lead to missed opportunities or unnecessary exposure to market volatility. Aligning my exit plans with overall financial objectives ensures my decisions remain strategic rather than reactive.

Chasing Quick Profits

Pursuing immediate gains often leads to impulsive decisions. If I focus exclusively on short-term profits, I might exit too soon, missing out on substantial long-term returns. For instance, selling a token after a minor price spike without considering its broader potential could result in lost growth opportunities. Evaluating market trends and project fundamentals helps me differentiate between sustainable value and temporary price fluctuations, ensuring more calculated exits.

Mistake 5: Falling For Scams

Scams in the crypto and token investment space are increasingly sophisticated, making them hard to spot without vigilance. Identifying fraudulent schemes and understanding how to protect assets are crucial for avoiding unnecessary losses.

Trusting Unknown Sources

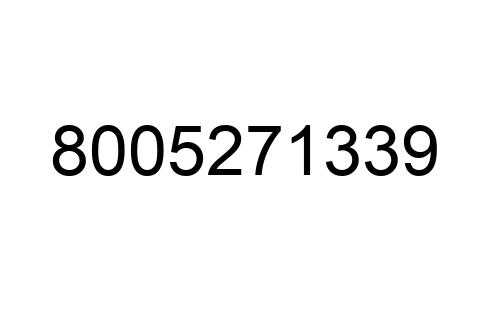

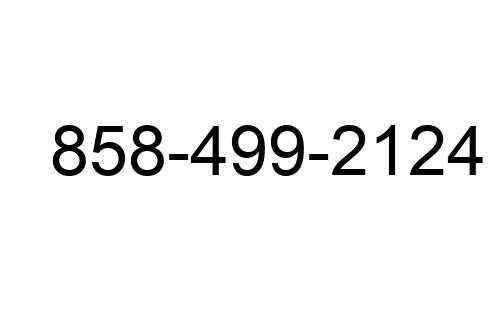

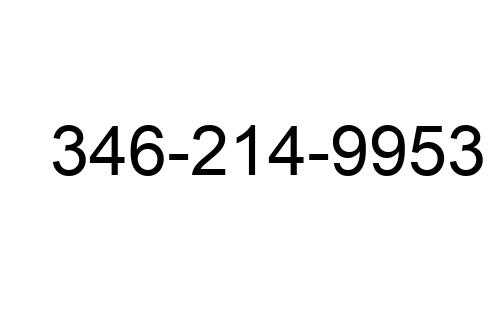

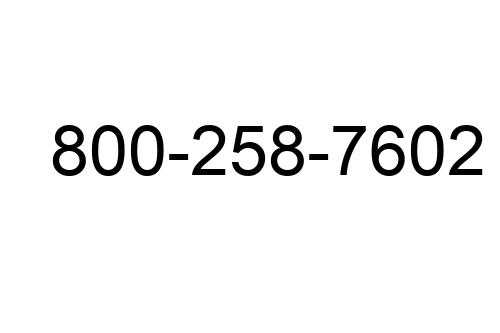

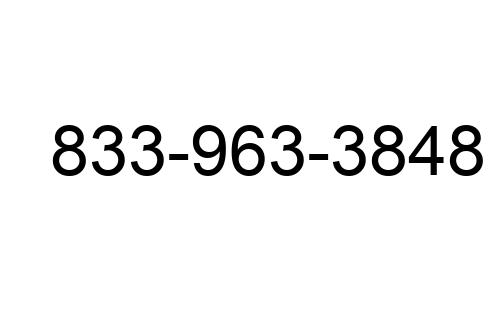

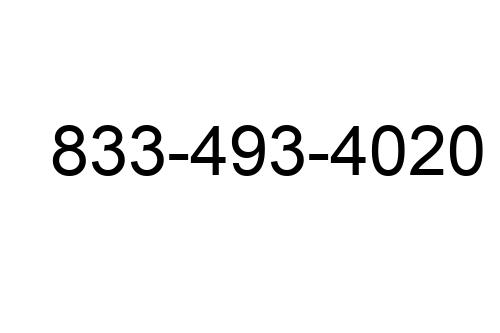

Relying on unverified sources of investment advice or token promotions introduces significant risks. Fraudsters often create fake websites, impersonate legitimate projects, or rely on social media to spread misinformation. I’ve seen cases where investors blindly trusted unsolicited messages or influencer endorsements, only to lose funds in rug pulls or fake token sales.

Cross-referencing information is vital. I always validate the credibility of the source by checking official project channels, such as their website and verified social media accounts. Reputable projects maintain transparent communication. Staying skeptical of too-good-to-be-true promises helps me avoid falling into traps.

Ignoring Security Best Practices

Neglecting security leaves assets vulnerable to theft or loss. Scammers exploit weak passwords, phishing emails, and compromised wallets to access funds. For example, phishing links disguised as wallet updates have led many investors to inadvertently share private keys or recovery phrases.

I consistently prioritize security measures. Using hardware wallets, enabling two-factor authentication, and regularly updating passwords protect my investments. When engaging with platforms or apps, I ensure they’re legitimate by verifying domain names and application sources. Maintaining these practices helps reduce exposure to scams and strengthens overall security.

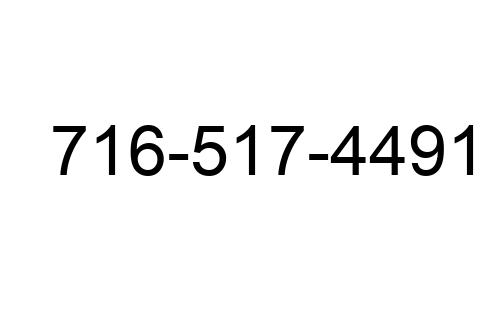

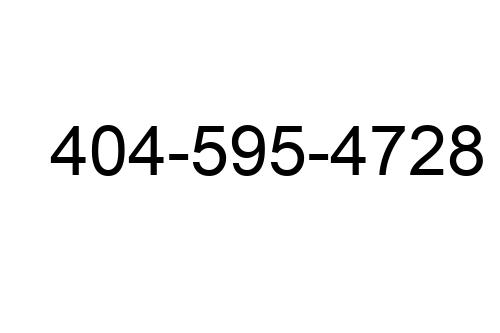

Market Analyst & Trading Strategist

Market Analyst & Trading Strategist