Predicting market trends has always been a mix of science and art, but let’s face it—analysts don’t always get it right. I’ve seen forecasts that looked flawless on paper yet fell apart when real-world factors came into play. It’s a stark reminder that even the sharpest models can’t account for every twist and turn.

Understanding Price Predictions And Real Trends

Price predictions aim to forecast future market trends, while real trends reflect actual market outcomes. Disparities between the two highlight gaps in methodology, interpretation, or unforeseen variables.

The Role Of Analysts In Market Predictions

Analysts interpret data, economic indicators, and market sentiment to predict price movements. They use tools, like statistical models and algorithms, to identify trends. For example, stock analysts rely on financial reports and technical analysis, while commodity analysts consider global supply-demand dynamics. Their projections guide business strategies, investment decisions, and policy-making.

Why Predictions Often Fall Short

- Predictions fail when unforeseen variables disrupt expected patterns.

- Macroeconomic shocks, such as recessions or geopolitical tensions, quickly alter market dynamics.

- Analysts also struggle with over-reliance on historical data, which may not account for changing contexts. For instance, technological disruptions or sudden regulatory changes often skew expected outcomes.

- Misjudging consumer behavior or market sentiment further amplifies inaccuracies, creating a mismatch between predictions and real-world trends.

Key Missteps In Price Predictions

Analysts frequently encounter pitfalls when attempting to forecast market trends. These errors often stem from flawed methodologies or the omission of critical variables.

Overreliance On Historical Data

Relying too heavily on historical data often leads to inaccurate forecasts. Analysts sometimes assume that past performance guarantees future outcomes, ignoring that economic conditions and market dynamics evolve. For example, during the COVID-19 pandemic, many price models failed because they were grounded in pre-pandemic data and didn’t factor in sudden shifts like supply chain disruptions. Historical data can be useful, but ignoring current and forward-looking indicators limits its predictive value.

Ignoring Market Disruptors

Overlooking market disruptors often skews predictions. Factors such as:

- technological advancements

- regulatory changes

- geopolitical events

can drastically alter market conditions. For instance, the rapid adoption of electric vehicles led to unforeseen shifts in commodities like lithium and cobalt, leaving predictions based solely on fuel-related markets outdated. Failure to integrate emerging disruptors results in substantial deviations from actual trends.

Misjudging Consumer Behavior

Misinterpreting consumer behavior weakens prediction accuracy. Analysts sometimes fail to account for shifts in priorities, preferences, or purchasing power, particularly during economic downturns or societal shifts. An example is the rise of sustainable products; despite historical dominance of traditional alternatives, the shift toward eco-conscious choices caught many off guard. Understanding nuanced factors like sentiment and cultural trends enhances the ability to predict real outcomes.

Case Studies: Price Predictions Gone Wrong

Errors in price predictions provide valuable insights into where analysts fall short. Examining specific examples helps expose flaws in methodology and assumptions.

Examples From The Stock Market

Stock market predictions have often been derailed by unanticipated events. In late 2021, many analysts forecasted sustained growth for technology stocks, citing strong Q3 earnings and high demand for digital services. However, 2022 brought interest rate hikes from the Federal Reserve, leading to sharp declines in tech valuations. Stocks like Meta (META) and Netflix (NFLX) dropped 65% and 50% respectively within months, highlighting analysts’ failure to account for macroeconomic shifts.

Missteps In The Real Estate Sector

Real estate predictions frequently underestimate the impact of government policy and economic conditions. Between 2007 and 2008, analysts projected stable housing prices based on consistent demand and limited supply. Instead, the subprime mortgage crisis caused a 25% drop in U.S. home values (per the S&P/Case-Shiller index) by 2012. Misjudging the volatility of financial markets and lending practices led to widespread inaccuracies during this period.

Failures In Commodity Price Predictions

Commodity forecasts suffer from disregarded geopolitical and environmental factors. In 2014, experts predicted oil prices above $100 per barrel for extended periods, citing steady demand in growing economies. Instead, crude oil fell below $50 by early 2015. Increased production from U.S. shale and lower OPEC cohesion disrupted forecasts. Similarly, agricultural commodities like wheat and coffee have experienced abrupt price shifts driven by climate events, which many models overlooked.

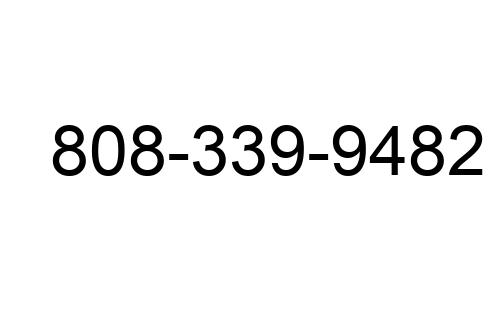

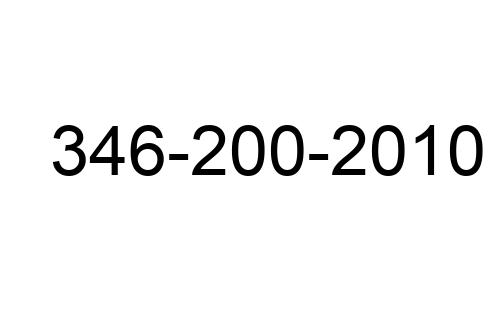

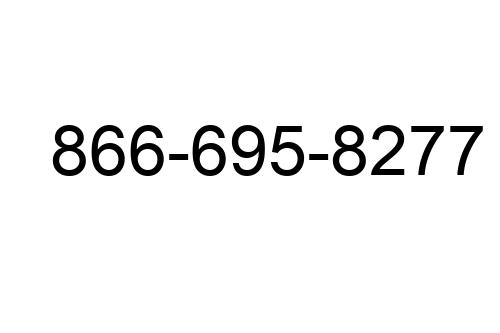

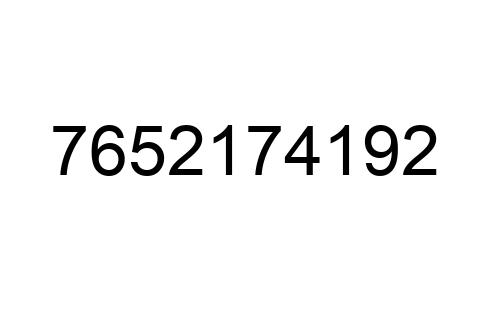

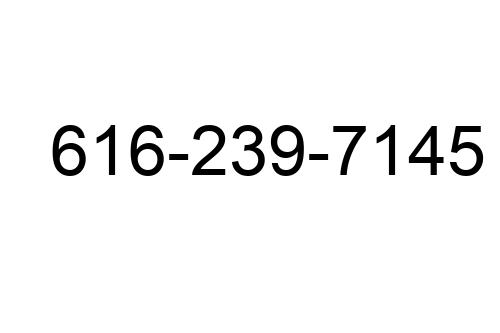

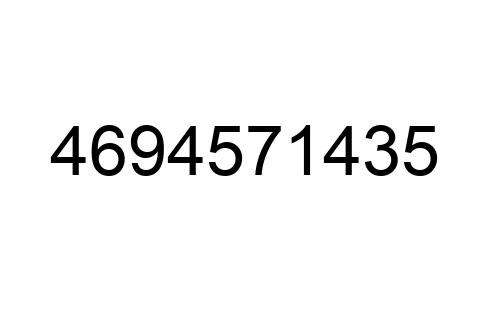

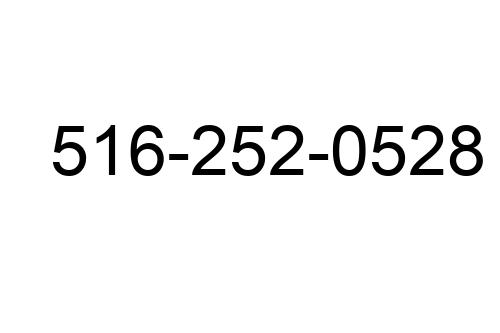

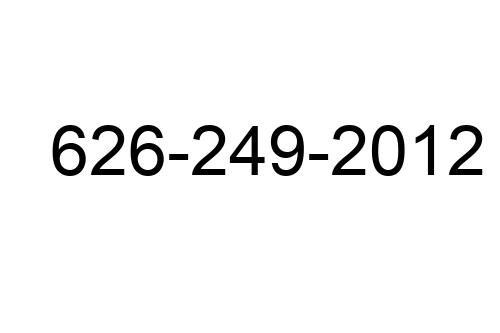

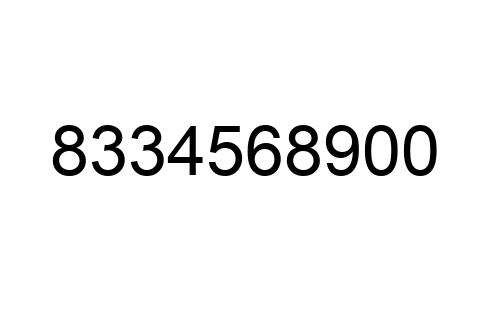

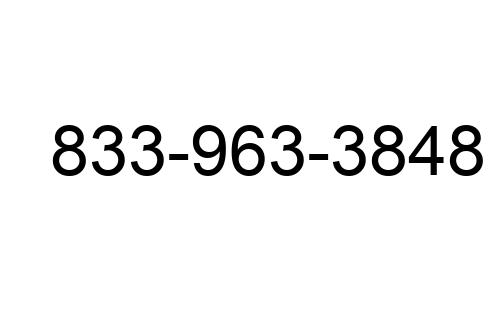

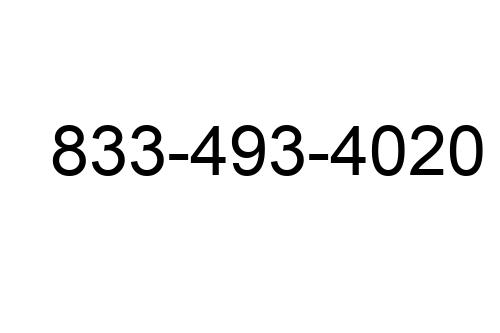

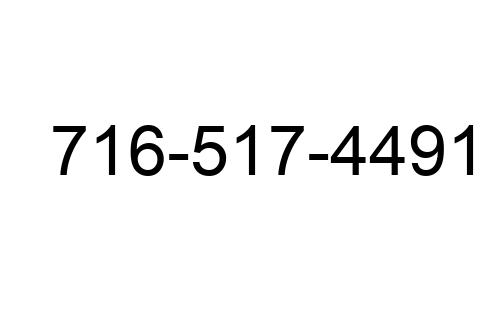

Market Analyst & Trading Strategist

Market Analyst & Trading Strategist