Overtrading Based on Emotion

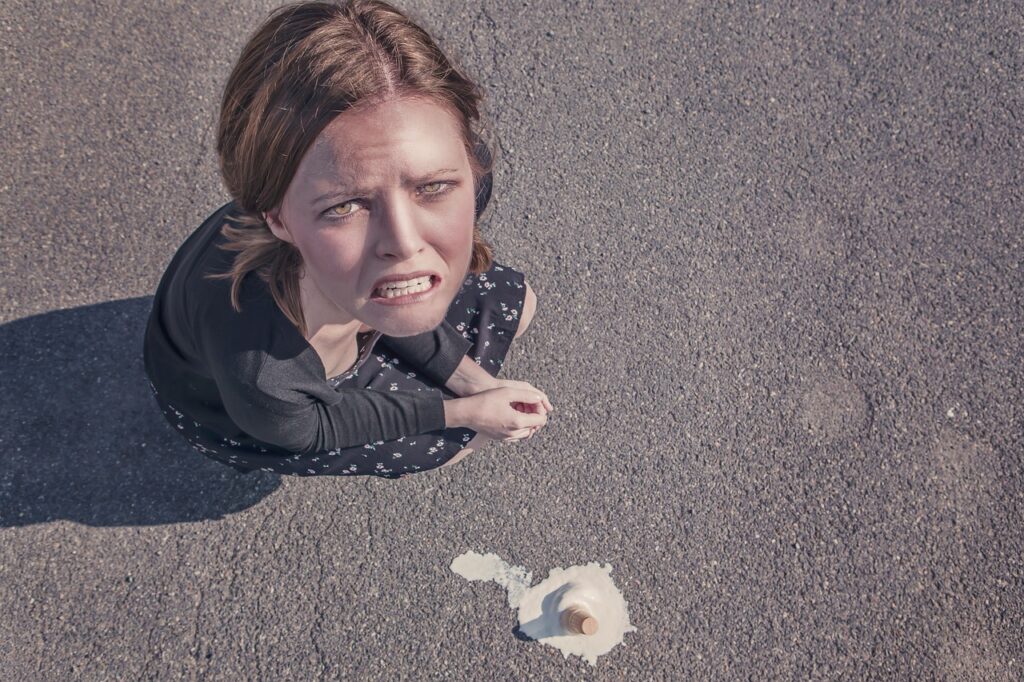

In crypto, reacting fast isn’t always a flex it’s often a mistake. Impulsive buys and panic sells might feel right in the moment, especially when charts are surging or bleeding out. But over time, this kind of emotional trading chips away at gains. You’re not investing you’re chasing noise. And noise doesn’t build wealth.

Market swings feed human instincts. Greed whispers when a token 10x’s overnight. Fear screams when it crashes by breakfast. Either way, logic gets drowned out. The result? You buy high, sell low, and repeat the cycle while convincing yourself it’ll be different next time.

The fix isn’t willpower it’s systems. Smart traders use automated rules like limit orders, stop losses, and DCA schedules to keep emotions on a leash. You decide your guardrails when thinking clearly, not while you’re sweating over a red candle. Less panic, more discipline.

You can’t control the market. But you can control how you respond to it.

Ignoring Risk Management

Failing to manage risk is one of the fastest ways to lose capital in crypto markets, especially during periods of unpredictable volatility. Many investors focus solely on upside potential while neglecting the crucial safeguards that preserve profits and minimize losses.

Set Position Sizes Intentionally

Jumping into trades without a clear idea of how much to invest per position can lead to overexposure and emotional decision making. Define your investment limits before entering any token, based on your total portfolio size and risk tolerance.

A common rule: allocate no more than 1 5% of your portfolio per trade

Adjust your sizing depending on token volatility and conviction level

Don’t increase position size to chase losses or react to FOMO

Avoid the “All In” Mentality

Putting everything on a single token no matter how promising it seems is a high risk move. Even proven projects can swing wildly based on market conditions, regulatory news, or social sentiment.

Diversifying across different sectors and token types reduces risk

Avoid betting your entire capital on trending or meme based assets

Resilience comes from a balanced strategy, not blind conviction

Use Stop Losses and Diversification to Protect Capital

Stop loss orders and portfolio diversification aren’t just for traditional finance they’re powerful safeguards in crypto. Setting clear exit triggers reduces the likelihood of panic selling or holding losing positions for too long.

Place stop losses based on technical levels or percentage loss tolerance

Consider spreading investments across stablecoins, utility tokens, and long term holds

Regularly rebalance your portfolio to adapt to market shifts

Risk management isn’t about eliminating risk entirely it’s about controlling exposure so you can stay in the game longer, with clarity and confidence.

Entering Without an Exit Strategy

Most traders focus hard on picking the right moment to buy. But knowing when to sell is just as critical arguably more. Without a solid exit plan, you’re flying blind in a market that doesn’t care about your gut feelings.

It’s easy to fall into the “just one more pump” trap. You watch your gains climb, tell yourself to wait a little longer, and then… crash. Opportunity gone. Profit on paper isn’t profit until it’s locked in.

Smart exits don’t happen by accident. Top traders set targets, percentages, or situational rules like selling 25% every time a token hits a certain milestone. Others trail gains with stop loss orders to capture upside while protecting the downside.

Planning when and how to get off the ride keeps emotion in check. It forces discipline. And in a market that thrives on volatility, discipline is your best defense.

Figure out your exit before FOMO or fear starts calling the shots. You’ll sleep better and bank smarter.

For a deeper look at timing exits, see exiting a trade wisely.

Blindly Chasing Hype

Hype is everywhere in crypto, and it’s easy to get swept up in narratives that promise massive gains. But acting on excitement alone often leads to disappointment or worse, substantial losses. Recognizing the warning signs before investing can help protect both your portfolio and your peace of mind.

Spotting Red Flags in Trending Tokens

Before jumping into the next viral token, ask critical questions:

Is the project backed by anonymous developers with no track record?

Are there unrealistic promises of massive returns in short time spans?

Is the token heavily shilled by influencers without clear disclosures?

Does the project lack a clear roadmap or whitepaper?

Being cautious doesn’t mean avoiding trends altogether it means approaching them with skepticism and analysis.

Separate Utility From Marketing Fluff

Create a mental filter to distinguish actual value from buzzwords. Projects that talk a big game but lack substance should raise concerns.

Look for clear use cases that solve real world problems.

Gauge if the token has any function beyond speculation.

Check if there’s active development or just surface level updates.

Determine whether the roadmap has achievable milestones, not just vague goals.

Marketing alone doesn’t make a project worthwhile. Dig deeper to distinguish hype from potential.

Tools to Evaluate Before You Buy

Rather than relying on social media noise, use verifiable data and tools for decision making:

Explorer sites like Etherscan or BscScan to research wallet activity and token distribution

Tokenomics breakdowns that explain supply, burn mechanisms, and allocation

Crypto ranking platforms such as CoinGecko and CoinMarketCap for fundamental metrics

Community and developer activity on GitHub and Discord to check real engagement

Audit reports from reputable firms to review smart contract vulnerabilities

Before investing a single dollar, look for evidence not excitement.

Approaching hype with healthy skepticism helps you avoid pump and dump traps and invest with strategy instead of sentiment.

Underestimating Volatility

Volatility isn’t a surprise in crypto it’s the norm. Prices can swing 20% in hours, and pretending otherwise does more harm than good. Smart investors don’t try to outguess the chaos; they plan for it. That means building a strategy that holds up when the market dives, not just when it pumps.

Stablecoins are more than parking spots. They’re shock absorbers. Having a slice of your portfolio in USDC, USDT, or DAI can give you room to breathe and buy when others panic. Hedging is simple in concept: use what’s stable to balance what’s risky. You don’t need a finance degree to make it work just a willingness to map your exposure and protect your downside.

Then there’s the mental game. Watching your tokens bleed red is brutal. But reacting emotionally usually makes it worse. The pros? They stay calm, zoom out, and follow their plan. Your brain will scream to sell at a loss or double down irrationally. Read the chart, not your feelings. Write your worst case scenario down when you’re cool headed then stick to the plan when it hits.

Volatility doesn’t have to wreck you. Prepare for the mess, pad your position, and don’t let fear drive the trades. That’s how you survive crypto long term.

Neglecting Education and Research

Staying informed isn’t optional in crypto it’s essential. Relying on outdated knowledge or old assumptions can quickly lead to poorly informed trades, misjudged risks, and missed opportunities. In a space that evolves daily, passive investors get left behind.

Why Falling Behind Costs You

Crypto protocols, tokenomics, and market sentiment change fast

News, regulations, and platform updates shift the trading landscape

FOMO from old information leads to poorly timed entries or exits

In short: knowledge depreciation in crypto is real and costly.

Building a Research Habit That Sticks

Developing a consistent research routine helps you cut through distractions and hype. Make education part of your process, not an afterthought.

Set weekly time to review news, explore new projects, and revisit your portfolio

Use curated sources like crypto newsletters, developer blogs, and reputable analysts

Join community forums (Discords, Reddit, Twitter threads) to learn from others and test your assumptions

What to Focus On: Key Metrics and Documents

Reading whitepapers and understanding token mechanics sets you apart from casual traders. While hype attracts, utility sustains.

Here are a few essentials to track:

Total supply and circulating supply: Understand scarcity and inflation potential

Token utility: What problem does it solve? Who needs to use the token?

Team and governance: Are the builders known and trustworthy? Is governance decentralized?

Roadmap milestones: Track progress versus promise

The more consistently you study, the sharper your trades become. In crypto, knowledge truly is compound interest.

Repeating the Same Mistakes

Most traders think they’ll remember every win and loss. They don’t. And that’s the problem.

If you’re not tracking every trade entry point, exit point, reason for buying, reason for selling you’re flying blind. Patterns (bad ones and good) slip through the cracks without a clear record. And without looking back, there’s no moving forward.

Post trade reflection isn’t about beating yourself up. It’s about spotting what actually worked. Did you hold too long? Did FOMO lead to a bad entry? Which setups gave the best returns? Writing these answers down turns your trading from chaos into strategy.

The most consistent traders run systems. That starts with tracking, reviewing, and adjusting. It’s how you stop bleeding capital on repeat mistakes and build a modern playbook that fits your goals, your risk, your edge.

For a deeper dive on refining your exits, don’t miss this read: Exiting a Trade Wisely.

Founder & Blockchain Visionary

Founder & Blockchain Visionary